Helpful saving hacks to help with the cost of living

But consumer experts at NetVoucherCodes.co.uk have identified useful ways to save cash by completing monthly saving challenges as well as advice on how to knock hundreds off holiday expenses.

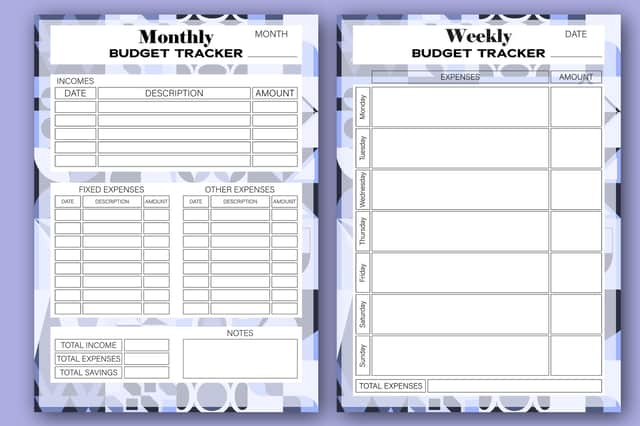

Digital budget planner – Start the year off by downloading a digital budget planner so you can visually track how much you’re spending and in which areas.

Advertisement

Hide AdAdvertisement

Hide AdGet a smart meter – Having the physical amount in front of you can let you see clearly how much is being spent on gas and electricity.

Start a side hustle – A savvy way to earn extra cash in the new year is to earn more and spend less by starting a side hustle.

Enter free giveaways – Social media giveaways are also an easy way to grab a freebie.

Set measurable savings goals – While it’s great to save as much as possible, don’t just throw everything into savings only to realise there’s not enough money left to pay for the bills.

Advertisement

Hide AdAdvertisement

Hide AdShop during sale events – January sales are one of the prime sales events over the year, where many retailers knock down their prices after the Christmas rush.

Book 2024/25 holidays now – When it comes to travel prices, the earlier you book, the better.

Shop around for deals – Have a look at different outlets offering the same type of products, both online and in-person.

Join community groups for free activities – Signing up for online community groups means you have access to wider information about free local activities going on in the area.

Advertisement

Hide AdAdvertisement

Hide AdSign up for loyalty schemes – Each time you decide to shop at a retailer, have a look if they have an app available or go straight to their website and join their reward schemes.

Book free cancellation trips – Booking free cancellation trips can provide extra insurance to get money back on a cancelled trip.

Sign up for email subscriptions – Even if they end up in your junk mail, it’s worth signing up for email subscriptions every time you purchase an item online, as you can be offered exclusive free items or early discounts before they go live to other consumers.

Freeze leftovers from Sunday roasts – Freezing food and meal prepping is always a handy way to save on food costs.

Advertisement

Hide AdAdvertisement

Hide AdThe 50:30:20 split – When the monthly wage comes through, allocate 50 per cent of it on bills and essentials, 30 per cent on leisure and 20 per cent on savings.

Use a credit card – When buying a large purchase item, pay for it on finance or directly by credit card to build up your credit score.

Have spend-free weekends – Dedicate one weekend a month where you’re going to have a spend-free weekend, where you can go for long walks in the park, get crafty in the kitchen with existing cupboard ingredients, or even just settle down and binge watch a new TV box set.

Use fakeaway recipes – A fakeaway is always a delicious budget treat to have on a Saturday night.

Advertisement

Hide AdAdvertisement

Hide AdNotepad mystery box – Write down different amounts you’d like to put into your savings on separate pieces of paper and put them into a bowl. Every Sunday, draw out a different amount to determine how much money you will be putting into your savings that week.

Check for tax rebates – Often many find themselves accidentally paying too much tax, which can be reclaimed on the Government website.

Take part in free subscription trials – Brands offer freebies by signing up for subscription deals, whether it’s entertainment packages or beauty products.

Stick to non-branded foods – These can cost nearly 50 per cent less compared to other products even if there’s a lack of difference in price and quality.

Advertisement

Hide AdAdvertisement

Hide AdPut locks on banking pots – Virtual banks often allow for savings pots to be locked and only accessible on certain dates.

Stick to the plan – Don’t just stick to the budget for January and forget about it for the rest of the year, make it a personal goal that you’ll stick to the saving targets so that the rewards will be greater by the end of next year.

For more ways to save in 2023 visit NetVoucherCodes.co.uk website.