Cost of living: Single Brits face paying £630 more on rent and food - expert tips on how to save

and live on Freeview channel 276

New research has found single people in the UK could pay up to £630 more a month on living expenses amid the cost of the living crisis.

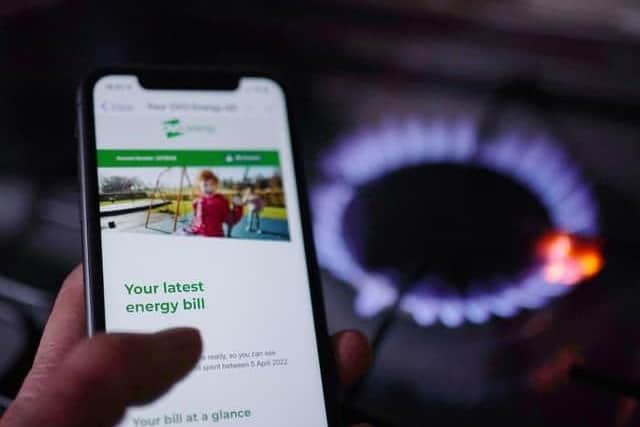

Ocean Finance used ONS data to calculate the average monthly costs for single and coupled-up Brits including utility bills, rent, monthly food shop and more. Their research found that a single person will pay £1,910.93 per month, whereas a person in a couple will pay £1,280.63.

Advertisement

Hide AdAdvertisement

Hide AdWhen breaking down the costs, research found single Brits will pay £363 more a month on housing, utility bills, internet, a TV licence and council tax. Rent was the biggest contributor with a single person paying, on average, £674 a month and a couple paying just slightly more at £866 a month, so £433 per person. Additionally, a monthly food shop costs single Brits £90 more.

The research also revealed that singles pay £33 extra per month to stream films and music. A recent study found that, on average, UK households have seven monthly subscriptions and memberships with the likes of Netflix, Amazon, Spotify and the National Trust. With this figure in mind, Ocean found that each month, singles pay an average of £82.09 whereas people in couples pay just £48.36 each. This is £33.73 more.

So, how can you save on bills if you’re living in a single person household? Here’s some tips from the experts at Ocean Finance.

Five top tips on how to save money if you’re single

Ocean Finance has offered tips for those who are single, on how they can make your money go further:

- Partner with a friend - with offers like a Two Together Railcard or Spotify Duo account, you can partner with a friend to cut your outgoings.

- Cut your subscriptions - cancel the ones you use least and see if you can reduce the ones you’re keeping by lowering your packages or buddying up with a friend to share an account - you might be paying for more than you need.

- Buy in bulk - the general rule when it comes to food shopping is “the smaller the packet, the more it’ll cost.” Try buying in bulk and splitting food into the portions you need, freezing or by storing the extra in airtight containers. You can also batch cook your meals to help reduce costs and save you time.

- Look for discounts - some bills are cheaper for single-person households. You’re eligible for a 25% discount with council tax and you can apply for a rebate if you’ve been overpaying.

- Switch to the right tariffs - by choosing the right tariff, a single person can reduce their monthly spending on bills. For example, changing your water bill to a metre rather than a set fee can give you a significant reduction.

Comment Guidelines

National World encourages reader discussion on our stories. User feedback, insights and back-and-forth exchanges add a rich layer of context to reporting. Please review our Community Guidelines before commenting.